This article discusses the Pan-African venture capital firm Breega, its investment strategy, and the African VC scene. Here are some key points:

Breega’s Investment Strategy

- Breega invests in early-stage startups across Europe and Africa.

- The firm has a pan-African approach, investing in largely untapped markets such as Senegal.

- They prioritize breadth over depth in larger markets with more potential for VC-scalable businesses.

The African VC Scene

- Breega’s CEO believes that the African VC scene is becoming more cautious, especially regarding entrepreneurs they choose to invest in.

- Many Africa-only or country-specific investors are struggling to participate meaningfully due to a lack of capital deployment.

- The article suggests that there may be opportunities for co-investing between larger firms and smaller funds.

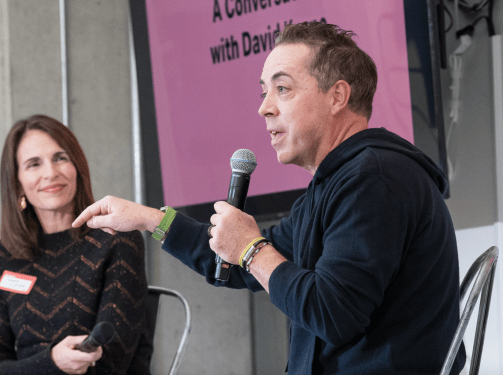

Key Quotes

- "Africa gets 1% of venture capital, yet we have 18% of the population. And so, from that perspective, our role as Breega, being a European and African tier-one investor, is also to be able to go where others honestly can’t go because we believe that there’s value to be created there." – Melvin

- "The advantage of people starting a business from smaller countries is that they usually start thinking globally from day one. And that’s the founders we’re thinking about right now." – Ben

Overall, the article suggests that Breega’s pan-African approach and investment strategy are well-suited to the current state of the African VC scene, where larger firms may be hesitant to invest in smaller markets or entrepreneurs.